- Risk Management for Projects

Usually people get confuse between risk and issues, risks are potential threats which might or might not impact and issues are something which have already impacted. Hence, if risks are well managed, it can turn into opportunities and provide unexpected gains to the projects.

Risk management is a common process in most projects. It is whereby the threats to a project are identified, assessed and controlled. By definition, a risk is any indeterminate occurrence of a condition which will have an effect on the objective of the project, if it happens. Some of the objectives that can be affected include the cost, scope, schedule and the quality.

Risk Management Plan

In order to mitigate risks, there are a number of things that can be done. A comprehensive risk management plan will entail:

When it comes to the identification of the risk, the most important thing is to be honest when identifying the risk. When the risk is identified early enough, it will be easier to tame it and this will significantly reduce the overall impact or provide an unplanned gain.

Different Risks that May Affect a Project

There are quite a number of risks that may end up having an impact on the project. The impact may be positive or negative. Some of these risks include:

✓ Relationship between the member of the team involved in the project

✓ Technology that is being used

✓ The alignment of the project with the culture, objectives of the company or the business area

✓ Communication of prerequisites, assumptions and the out of scope attributes.

✓ The general environment where the project is going on.

Risk Analysis

When it comes to risk analysis, you should be keen to define the risk and not the effect or the cause. One crucial factor is that, you should be clear on ‘so what’ happens next, as this will help in effective risk management. There are different types of mindset companies adhere towards risk analysis. Certain tend to be risk averse and others take an attitude of risk takers.

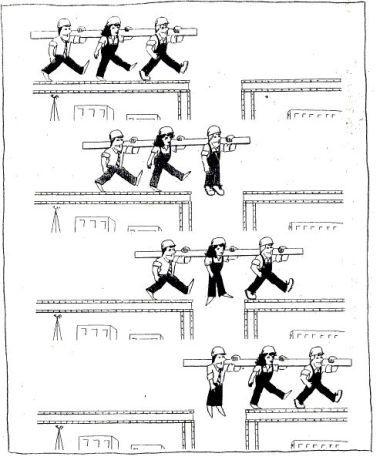

Risk Averse or Risk Taker?

Risk averse refers to opposing the risk, and by so doing, companies perform over analysis to mitigate unreal risk levels. When a company becomes risk averse, they tend to be over protective and too cautious. They use a pessimistic approach in determining the impact of the risk.

For them, life is full of risks thinking extremely negative over a consequence without appropriately analyzing the probability. Such attitude makes them lose over a potential gain they would have achieved by taking the risk. Higher the risk, higher the return if turned positive.

On the other hand, the risk taker refers to an organisation that takes risks or seeks risks so as to see if there is an opportunity, which they can maximise on. They find so much joy in challenging situations, and every time they have to handle risks, they are over optimistic. For example, companies who envision to grow very aggressively in a short span tend to overcommit upon deliveries without any risk analysis. Ultimately, they end up causing hefty losses or potential project failures.

The solution lies in being able to find the right balance when it comes to risk management. All risks should be analysed properly considering its impact and probability. Companies should ensure risks are openly discussed and project managers should encourage team members to build a culture of raising and evaluating risk continuously. When this is done, you will be able to balance the risk averse and risk takers in the team and come up with the perfect strategies to monitor and control the project risks.